Article Directory

The search for the “next Nvidia” has become something of a sport in financial markets. It’s a narrative hunt, an attempt to identify the next technological paradigm shift and the single company that will define it. Lately, the market’s collective gaze has landed on quantum computing, and specifically on D-Wave Quantum (QBTS). The chatter on social media and retail investor forums is unmistakable: a pattern of excitement built on the premise that D-Wave’s quantum annealing systems are to the next generation of computing what Nvidia’s GPUs were to the AI revolution.

It’s an alluring story. But as with any compelling narrative, the responsible next step is to set the story aside and examine the numbers. The core of my work is to measure the distance between a corporate narrative and its financial reality. In the case of D-Wave, that gap isn’t just a gap; it’s a chasm. The comparison to Nvidia isn’t merely premature; it’s a fundamental misunderstanding of what made Nvidia a generational investment in the first place.

The Narrative's Architecture

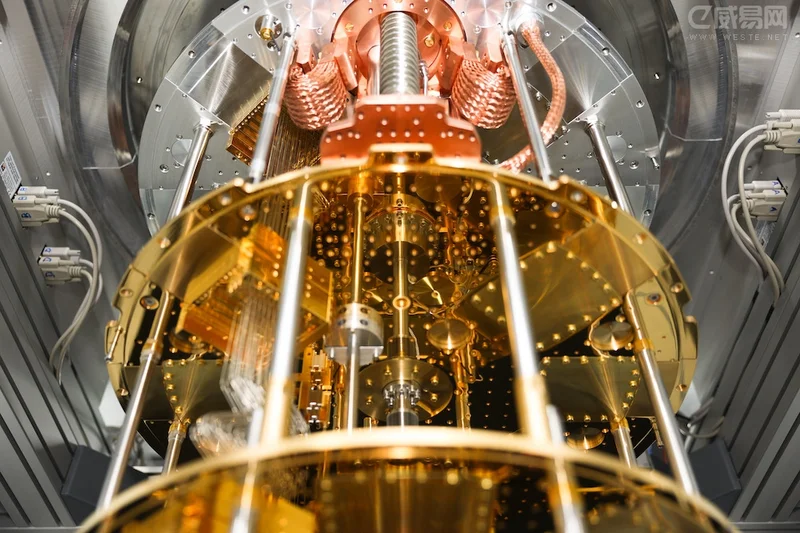

Let’s first be fair and dissect the narrative on its own terms. The comparison between D-Wave and Nvidia, as explored in articles like Quantum Computing Investment Boom: Can D-Wave Become the Next Nvidia?, is rooted in their shared identity as pioneers of a new computational architecture. Nvidia didn’t just make better graphics cards; it created a platform for parallel processing (CUDA) that unlocked the AI boom. The bull case for D-Wave posits a similar trajectory. Its quantum annealers are designed to solve complex optimization problems—logistics, risk modeling, drug discovery—that could choke even the most powerful classical supercomputers.

Proponents will point to the company’s revenue growth, which has, at times, shown triple-digit year-over-year increases. This is the data point that fuels the hype. It’s easy to extrapolate that line item into the stratosphere and imagine a future where D-Wave’s systems are as essential to industry as Nvidia’s chips are today. The company is actively working with partners in defense and automotive, providing just enough anecdotal evidence to suggest that commercial adoption is just around the corner.

This is how a powerful market story is built. It combines a grand, world-changing vision (quantum supremacy) with a few selectively chosen data points that suggest exponential momentum. The problem arises when you zoom out and view those data points in their full context.

A Discrepancy in the Financials

The momentum narrative begins to fray the moment you place the revenue figures next to the operational costs. D-Wave’s most recently reported quarterly revenue was $3.1 million. That’s not a rounding error. For a publicly traded company positioned as the heir to a trillion-dollar behemoth, it’s a startlingly small number. Now, place it alongside the operating loss for the same period: about $26.5 million—to be more exact, a loss of $26,458,000.

The company is spending nearly nine dollars for every dollar it brings in. I've looked at hundreds of filings for early-stage tech companies, and this particular ratio of revenue to cash burn is a significant outlier. This isn’t a growth story; it’s a survival story funded by constant capital raises, a strategy that inevitably and relentlessly dilutes the value for existing shareholders (a crucial detail often lost in the retail frenzy).

This is where the Nvidia comparison completely collapses. Nvidia’s ascent was built on decades of steadily growing profitability and a robust, defensible business model. D-Wave’s model, for now, is based on the promise of a technological breakthrough that has yet to prove its commercial superiority over classical computing in a scalable, cost-effective way.

Comparing D-Wave to Nvidia is like looking at a brilliant architectural blueprint for a city-sized arcology and calling it the next Empire State Building. One is a spectacular and unproven vision of the future; the other is a steel-and-concrete reality that has been generating revenue for nearly a century. Can the blueprint become a reality? Perhaps. But you don’t value the blueprint at the same price as the finished, occupied skyscraper.

The core question isn't whether quantum computing is revolutionary. It almost certainly is. The question is whether D-Wave’s specific approach—quantum annealing—will be the winning horse, and if the company can survive the colossal cash burn required to reach the finish line. What happens if a competitor’s gate-based quantum system achieves a critical breakthrough first? How does a company build a defensible moat when its very technological foundation is still the subject of intense scientific debate and experimentation?

The Unit Economics Don't Compute

Ultimately, the D-Wave-as-Nvidia thesis fails on the most fundamental level: unit economics and market maturity. Nvidia sells a product with proven, immediate, and almost insatiable demand within a well-understood market. D-Wave is selling access to a technology that is still largely in the proof-of-concept stage, searching for a "killer app" that unequivocally demonstrates its economic advantage over highly optimized classical algorithms.

Labeling D-Wave as the "next Nvidia" isn't just optimistic; it's a category error. It mistakes a high-risk venture into deep tech for a scalable, high-margin manufacturing and platform business. Investing in D-Wave today is not an investment in a growing business. It is a speculative bet on a scientific outcome, and those are two entirely different financial propositions. The data is clear: one is a financial engine, the other is a research project funded by the public markets.