Article Directory

The Dividend Is a Distraction. The Real Story Is the Machine.

When I first saw the Bank of America Declares Fourth Quarter 2025 Stock Dividends - Yahoo Finance, my initial reaction was, admittedly, a shrug. A quarterly dividend of $0.28 per share. Okay. For a financial analyst, that’s a data point, a signal of stability. But for someone like me, who spends his days obsessed with the bleeding edge of what’s possible, it felt like reading a weather report from last Tuesday.

Then, I read it again. And I honestly just sat back in my chair, speechless. Not because of the numbers, but because of what the numbers represent. We see these announcements all the time, and we’ve become so numb to them that we miss the miracle. The real story isn’t the dividend. It’s the staggeringly complex, silent, and beautiful technological organism that makes a simple press release like this possible.

Imagine for a moment, you’re standing on a hill overlooking a massive, sleeping city at night. You see the gentle glow of millions of lights, but you don’t see the power grid, the substations, the thousands of miles of copper wire humming with raw energy that makes it all work. That’s what this dividend announcement is. It’s the glow. The machine behind it—the invisible network of data, software, and human ingenuity—is the real marvel. This is the kind of thing that reminds me why I got into this field in the first place.

The Architecture of Trust

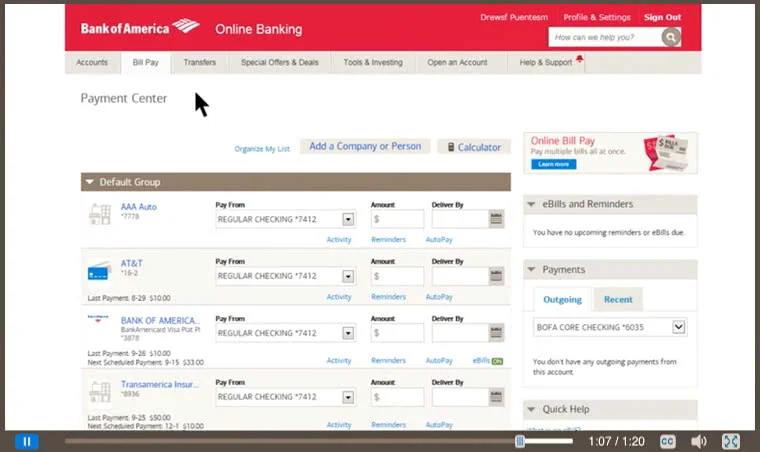

Let's pull back the curtain. Bank of America isn't just a collection of buildings with vaults. It’s a living data ecosystem serving nearly 70 million people and 4 million small businesses. It’s 15,000 ATMs and 3,600 financial centers, all connected in real-time to a central nervous system. Fifty-nine million people—a population larger than Spain—log into its digital services, performing transactions with the casual tap of a finger.

To declare a dividend means that on a specific date, this colossal system has to know, with perfect accuracy, who owns every single share of its stock and then, on another specific date, execute a flawless transfer of funds to millions of individual accounts across the globe—and the speed and scale of this is just staggering, it means the gap between an idea in a boardroom and a tangible deposit in millions of pockets is closed by a river of data flowing faster than we can even comprehend.

This isn't just about big servers. This is about an architecture of trust, built on decades of software engineering. Every transaction has to be perfect. They rely on something called transactional integrity—in simpler terms, it’s a set of mathematical promises that ensures every cent is accounted for, that data is never corrupted, and that the system can withstand shocks without collapsing. It’s the digital equivalent of a suspension bridge’s engineering, invisible to the drivers but absolutely essential to their safe passage.

What kind of predictive analytics are running in the background to model cash flow and ensure this payment doesn’t disrupt the market? How many layers of cybersecurity are silently deflecting threats every microsecond to protect this process? The dividend isn’t a financial action anymore; it’s the output of one of the most sophisticated information processing machines ever built.

From Clay Tablets to the Cloud

Think about the history of commerce. For millennia, a ledger was a physical object—a clay tablet, a papyrus scroll, a leather-bound book. The speed of business was limited by the speed of a horse or a ship. The scale was limited by how many scribes you could fit in a room. We’ve just witnessed the digital equivalent of the invention of the printing press, but instead of democratizing knowledge, it has democratized transactional velocity.

This dividend payment is a quiet testament to a revolution that’s already happened. It’s proof that we’ve successfully built a global financial infrastructure that operates at a scale and speed that would have been pure science fiction to our grandparents. It connects a small business owner in Ohio with an investor in Tokyo through an invisible web of protocols and fiber optic cables.

Of course, with this immense power comes an almost sacred responsibility. Managing the financial data of 70 million people isn't just a technical challenge; it's an ethical one. The same system that can seamlessly pay a dividend must also be a fortress of privacy and a bastion of security. It’s a constant, high-stakes balancing act between innovation and stewardship. Are we having serious enough conversations about the societal implications of concentrating this much data-driven power? Are we, as citizens of this new digital world, prepared to be its responsible guardians?

The details of the public’s reaction to this specific dividend are, frankly, irrelevant. The market absorbs it, the stock price adjusts by a few cents, and life moves on. But we shouldn’t let the mundanity of the event blind us to the magic of the mechanism.

The Silent Triumph

So, what's the real story here? It’s that the future we’ve been talking about for decades hasn’t arrived with a bang, a flying car, or a robot butler. It’s arrived silently, in the background. It’s in the flawless execution of a billion-dollar transaction announced in a two-paragraph press release. It’s the quiet, constant hum of a perfectly functioning, hyper-complex system that we now take completely for granted. This isn't just a bank’s quarterly report; it’s a progress report on the human endeavor to build a truly connected world. And from where I’m sitting, the progress is breathtaking.