Article Directory

Zillow Says Homeownership Now Costs $16K/Year? Yeah, and Water's Wet.

The American Dream: Now Sponsored by Debt

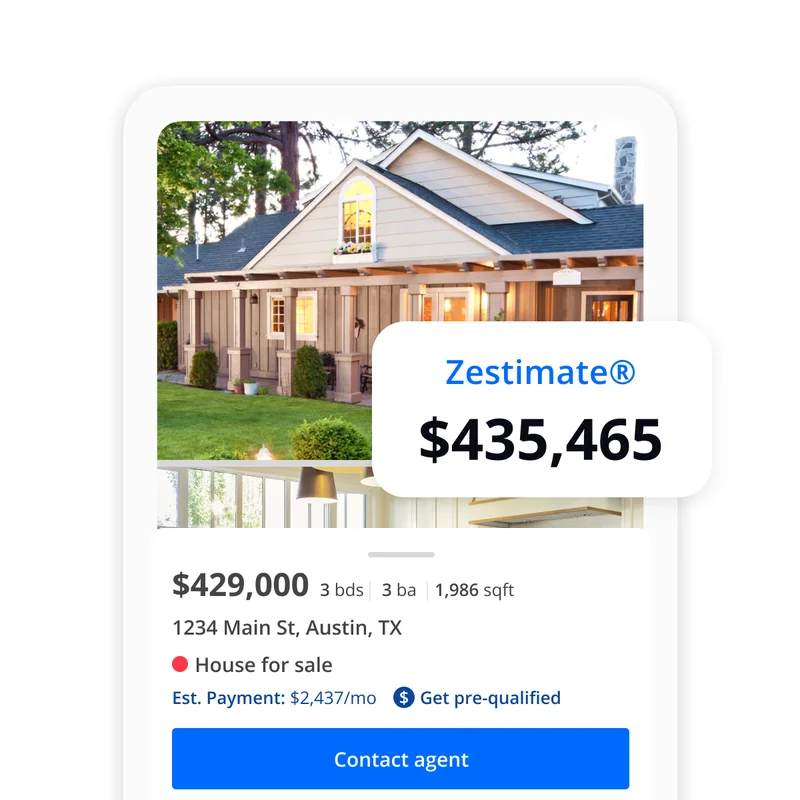

Oh, great, another study. This time, Zillow's telling us that the hidden costs of owning a home have ballooned to nearly $16,000 a year. Sixteen grand. As if the down payment, the mortgage, and the existential dread weren't enough.

Let's be real; who didn't see this coming? It's like being surprised that the sun rises in the East. Of course, it costs more to own a home. Everything costs more now. Inflation's a beast, wages are stagnant for most of us, and corporations are raking in record profits. It's the freakin' American Dream, alright—a dream sponsored by crippling debt.

Zillow, bless their heart, points out that these costs are hitting people already "stretched thin." Stretched thin? We're practically transparent at this point. You can see right through us to the empty bank accounts.

Coastal Elites and Florida Man Get Screwed Equally

The breakdown, according to Zillow, is mostly maintenance ($10,946), followed by property taxes and insurance. And guess where it's the worst? Coastal metros like NYC, San Francisco, and Boston. No surprises there. Try finding a decent apartment in those places for under, like, a billion dollars a month.

But here's the kicker: Florida's getting hammered too. Insurance premiums in Miami, Jacksonville, Tampa, and Orlando are skyrocketing. Why? Extreme weather events, of course. It's almost like ignoring climate change has consequences. Who would have thought? (Sarcasm, in case you missed it.)

Miami insurance premiums are up 72% since 2020. 72 PERCENT! That's insane. How are people supposed to afford this? Oh, wait, they're not. That's the whole point, isn't it? Price 'em out, consolidate ownership, and turn us all into renters forever. That's the plan. I'm sure of it.

And what's Zillow's solution? "Use personalized affordability tools." Right. Because a fancy calculator is going to magically conjure up an extra few thousand dollars a year. Give me a break. That’s like telling someone drowning to just try swimming harder.

The System's Rigged, Obviously

Kara Ng, some "senior economist" at Zillow, says insurance costs are rising "nearly twice as fast as homeowner incomes." Yeah, no kidding. It ain't just insurance, Kara. It's everything. It's groceries, gas, healthcare, and offcourse the ever-present student loan debt hanging over our heads. According to a recent Zillow Reveals the Hidden Costs of Homeownership report, these rising costs are making homeownership increasingly unaffordable.

Thumbtack home expert Morgan Olsen chimes in with the brilliant advice to "think of preventative maintenance as a safety net." Okay, Morgan, but what if I can't even afford the net? What if I'm already juggling three jobs just to keep a roof over my head? Is preventative maintenance going to pay my bills? I doubt it.

The whole system is rigged. It's designed to keep us scrambling, to keep us in debt, and to keep us from ever actually owning anything. They dangle the "American Dream" in front of us like a carrot on a stick, knowing full well that most of us will never reach it.

Then again, maybe I'm just being cynical. Maybe there's still hope. Maybe...nah, who am I kidding?

We're All Doomed, Aren't We?

Look, this Zillow report ain't exactly groundbreaking news. It's just another reminder that the deck is stacked against us. Homeownership is becoming a luxury, not a right, and the "hidden costs" are just another way to squeeze every last drop of blood from the working class. So, what's the solution? I honestly don't know anymore. Maybe move to a yurt in the woods and live off the grid. Or maybe just accept our fate as debt slaves and keep grinding until we drop. Either way, it ain't gonna be pretty.