Article Directory

The Great Quantum Charade: How Amazon Is Selling a Dream Wall Street Is Desperate to Buy

Let’s all just take a deep breath. I see the headlines, I see the breathless analyst reports, and I see the stock tickers glowing green. Amazon, the $2.35 trillion behemoth that sells you everything from dog food to server space, is now the darling of the quantum computing world, and Wall Street is acting like it’s just discovered fire.

Fifty-one out of 57 analysts are screaming "Strong Buy." Goldman Sachs is bumping its price target to $275. Wells Fargo is upgrading the stock to "Overweight." You can almost picture some junior analyst, three coffees deep in a Midtown cubicle, frantically highlighting a press release about "cat qubits" and telling his boss, "Sir, this is the paradigm shift we've been waiting for!"

Give me a break.

What we're witnessing isn't a technological revolution hitting the mainstream. It’s a masterclass in corporate storytelling, a perfectly executed hype cycle where the actual product is almost irrelevant. Amazon isn't selling quantum supremacy; it's selling the idea of quantum supremacy. And the Street, terrified of missing the next big thing, is buying it hook, line, and sinker.

A Solution in Search of a Problem

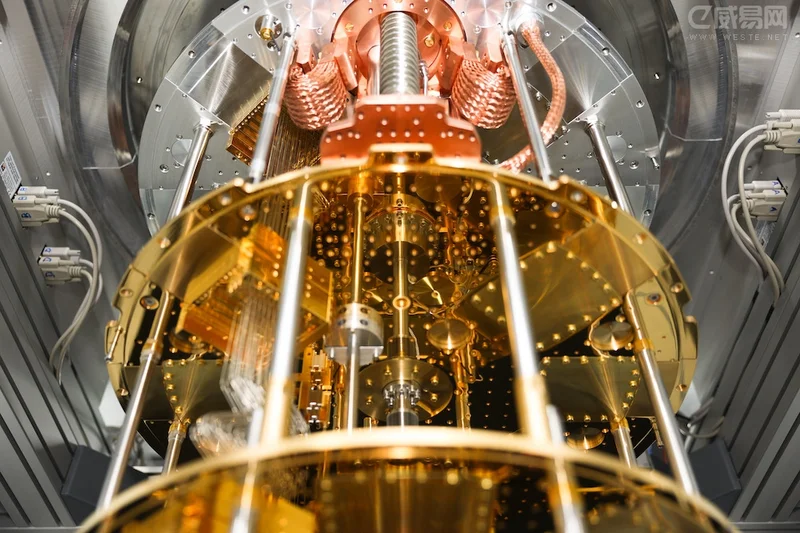

Let's look at what Amazon is actually doing. They unveiled a new quantum chip, "Ocelot," which they claim can cut error correction costs by up to 90%. They’ve added a 54-qubit processor from a company called IQM to their Amazon Braket cloud platform. They even have a new feature that bundles up to 100 quantum circuits into one task, making things run—get this—up to 24 times faster.

It all sounds incredibly impressive, doesn't it? It's meant to. These are numbers designed for a PowerPoint slide, not the real world. That 90% error reduction? It’s like a car company building a single prototype engine in a lab that gets 1,000 miles per gallon. It’s a fascinating scientific achievement, but you ain’t driving it to the grocery store anytime soon. And "24 times faster"? Faster than what, exactly? The baseline for this stuff is so slow and clunky that a 24x improvement is like going from a crawl to a brisk walk. We’re not talking about breaking the sound barrier here.

Amazon is building a beautiful, high-tech casino. They’ve polished the floors, hired the dealers, and are stocking the bar with top-shelf liquor. The casino is Amazon Braket, a platform that gives you access to all sorts of experimental quantum hardware from partners like Rigetti, IonQ, and now IQM. It’s a brilliant business model. They take on none of the risk of actually inventing the world-changing quantum computer themselves; they just provide the infrastructure for everyone else to come in and gamble their research budgets away.

And the high rollers are lining up. JPMorgan Chase just announced it’s plowing $10 billion into "frontier technologies," with quantum computing getting top billing. CEO Jamie Dimon says it's about reducing U.S. dependence on "unreliable foreign sources." A noble sentiment, I suppose. But what it really means is the biggest players in finance are now gripped by a terminal case of FOMO. They don't know what this quantum stuff does, but they know their competitors are buying it, so they need it too. This is just a race. No, 'race' is too clean—it's a chaotic, money-soaked mosh pit where everyone's flailing around, hoping to accidentally punch the future in the face.

The Analysts Don't Get It, and They Don't Have To

This brings us back to the Wall Street cheerleaders. Do you honestly believe the folks at Wells Fargo raising their price target to $280 have a deep, nuanced understanding of superconducting quantum processors? Does a single analyst at Goldman Sachs who reaffirmed their "Buy" rating actually know what a cat qubit is, or are they just repeating the two-sentence summary from Amazon’s press release?

They don’t, and it doesn't matter. They're not analyzing the quantum business. They can't. There's no cash flow, no P/E ratio, no tangible product to model. They’re looking at AWS revenue—up a tidy 17.5%—and seeing a healthy, profitable, world-eating monster. The quantum news is just the narrative spice, the little sprinkle of futuristic magic that lets them justify an even higher price target. It’s offcourse a brilliant strategy if your only goal is to pump the stock price.

It’s the same playbook every tech giant uses. Announce a moonshot project—self-driving cars, metaverse avatars, brain-computer interfaces—and let the media and the market fill in the blanks. The project doesn't have to work, not really. It just has to generate enough buzz to make the core business look more innovative and exciting. Amazon is playing this game better than anyone. They’re leveraging the very real, very profitable success of AWS to fund a speculative fantasy, and the market is rewarding them for it as if the fantasy is already a reality. They throw around terms like 'synergy' and 'first-mover advantage' and expect us to just nod along, and honestly... it’s exhausting.

Then again, maybe I'm the crazy one here. Amazon's market cap is $2.35 trillion. The stock is soaring. The world's biggest bank is throwing money at them. Who am I to argue with that? But what happens when the science doesn't catch up to the story? What happens when we’re five years down the road and quantum computing is still just a handful of niche, experimental applications? The hype train can only run on faith for so long before it needs some actual fuel.

So, We're Just Pretending This Is Real?

Let’s be brutally honest. Amazon has created the perfect product for our speculative age: a promise. They’ve packaged and sold a technological IOU. The real innovation here isn't in quantum physics; it's in financial marketing. They’ve managed to monetize the future, today. While academics and engineers toil away in labs on the real, grindingly difficult work of making these machines useful, Amazon is busy selling tickets to a show that hasn't been written yet. And as long as Wall Street is willing to pay for the tickets, the show will go on.