Article Directory

Title: The IRS Just Gave Us a Raise: How 2026's 401(k) Boost Fuels a Retirement Revolution

Okay, folks, let's be honest: the IRS isn't usually the first place we look for good news. But hold onto your hats, because they just dropped a bombshell that could seriously change the game for your retirement. I'm talking about the new 401(k) and IRA contribution limits for 2026, and trust me, this isn't just about a few extra bucks. This is about a fundamental shift in how we approach our financial futures.

The Power of Incremental Change

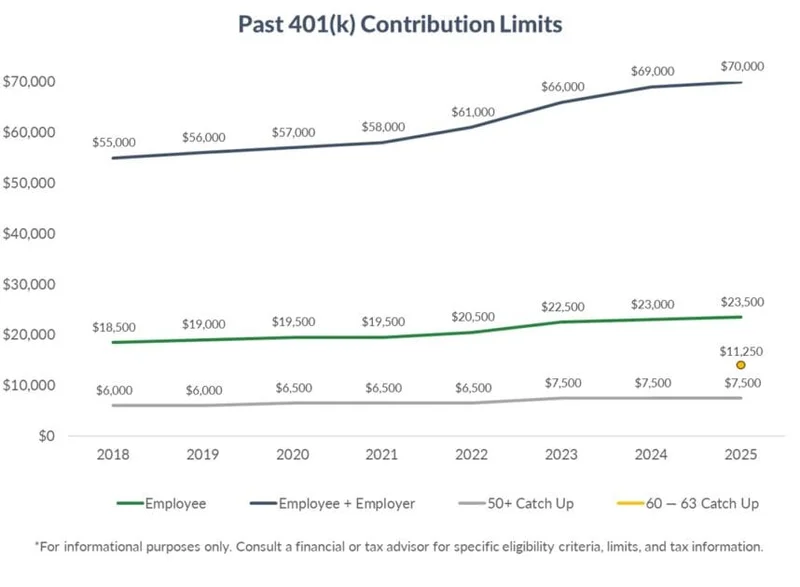

So, what exactly did the IRS announce? Well, for 2026, you can sock away up to $24,500 in your 401(k), a full $1,000 more than this year. And if you're 50 or older, that "catch-up" contribution jumps to $8,000, letting you stash a total of $32,500. For IRAs, we're looking at a $7,500 limit, up $500 from last year, with a $1,100 catch-up for the over-50s. 401(k) Limit Increases to $24,500 for 2026, IRA Limit to $7,500 It might not sound like a lot, but it's like compound interest, the small changes add up to something big!

Now, I know what some of you are thinking: "Aris, that's great for people who can afford to max out their accounts, but what about the rest of us?" And that's a fair point. But here's where the real magic lies: it's not just about the headline numbers, it's about the trend. The IRS adjusts these limits every year based on inflation, and while inflation isn't fun in the short term, it does mean these contribution thresholds keep pace with the rising cost of living.

Think of it like this: imagine you're slowly filling a bathtub with a leaky faucet. Each drop seems insignificant, but over time, the tub fills up. These incremental increases in contribution limits are like those drops, steadily building our retirement savings even when we don't feel like we're making huge strides. Isn't that awesome?

And it's not just about the money itself. Contributing to a 401(k) or IRA lowers your taxable income, which means you're paying less in taxes now while simultaneously building a nest egg for the future. It's a win-win!

The SECURE 2.0 Act has also thrown some fuel on the fire, with "super catch-up" provisions for those aged 60-63 and annual cost-of-living adjustments to IRA catch-up contributions. It’s like they are saying, “Hey, we get it, life happens, but we want to give you every opportunity to catch up and secure your financial future.”

Of course, there's a catch (there's always a catch, right?). The tax benefits of traditional IRAs are phased out for higher earners who are covered by a retirement plan at work. But even with these limitations, the increased limits provide more space for people to maneuver and optimize their savings strategies. What if you could use these new limits to re-evaluate your entire financial plan?

This reminds me of the early days of the internet. People dismissed it as a fad, a toy for nerds. But look at us now! The internet has transformed every aspect of our lives, and I believe these increased contribution limits have the potential to do the same for retirement.

But with this power comes responsibility. We need to be smart about how we invest, diversify our portfolios, and seek professional advice when needed.

I also found this comment on a Reddit thread about the announcement: "Finally, some good news! It's not a lot, but it's a start. Every little bit helps when you're trying to plan for the unknown." This is exactly the sentiment I'm talking about! People are hungry for positive change, and these increased limits are a step in the right direction.

The Dawn of a Secure Retirement

So, what's the Big Idea here? It's not just about the extra money, it's about the mindset shift. It's about empowering individuals to take control of their financial futures and build a retirement that's not just comfortable, but truly fulfilling. It's about fostering a culture of saving and investing, where people feel confident and optimistic about their prospects.

What does this mean for you? Imagine a future where retirement isn't a source of anxiety, but a time of freedom, exploration, and personal growth. Imagine having the resources to pursue your passions, travel the world, and spend quality time with loved ones. This isn't just a pipe dream, it's a real possibility and it’s becoming more tangible with every little bump.