Article Directory

Generated Title: Strategy's Bitcoin Binge: Genius Move or Just Another Dot-Com Disaster Waiting to Happen?

The Bitcoin Black Hole

So, Strategy—formerly MicroStrategy, because apparently, rebranding makes everything better—just dropped another $45.6 million on 397 Bitcoins. Big freakin' deal. They're calling it one of their "smaller buys." Right, because when you're sitting on 641,205 digital coins—worth a cool $69.1 billion, no less—what's a measly $45 million, eh? Pocket change.

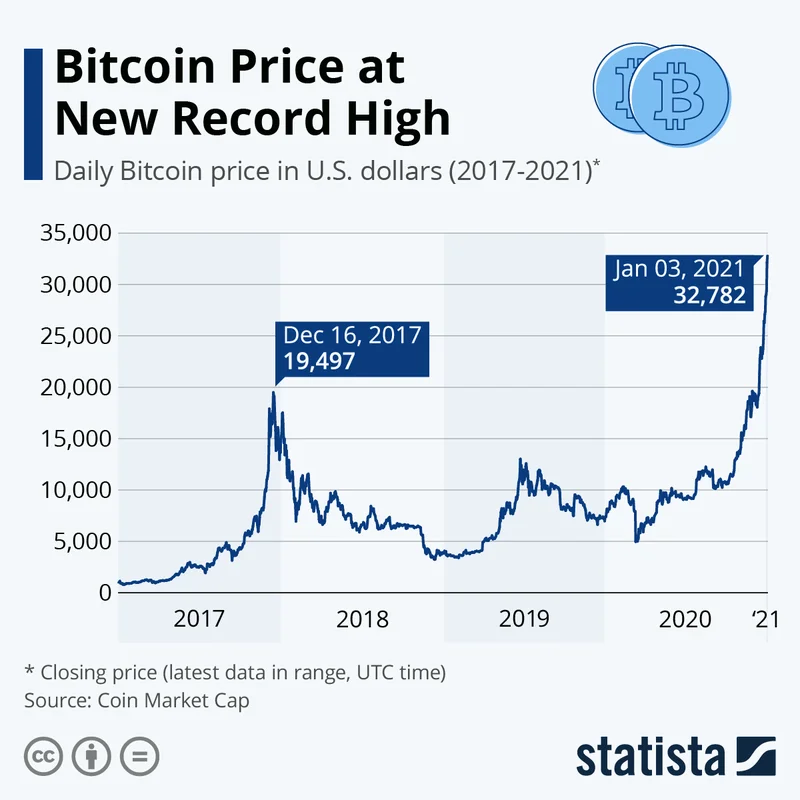

Let's be real, this whole thing smells like 1999 all over again. Remember Pets.com? Webvan? All those companies that promised the moon and delivered... nothing but shareholder tears? Strategy started buying Bitcoin in August 2020, claiming it was a way to "generate better returns." What they really generated was a massive pump in their stock price, which has risen over 1,700% since then.

But here's the kicker: their stock (MSTR) was down 3.6% on the news of this latest Bitcoin bonanza. Down 24% over the past month. What's that tell ya? Maybe, just maybe, the market is starting to realize that tying your entire company's fate to a volatile digital asset isn't exactly a sound long-term strategy. Offcourse, I could be wrong.

And don't even get me started on this "declining multiple to Net Asset Value (mNAV)" crap. Apparently, that's some fancy finance term that basically means investors are starting to question whether Strategy can actually, you know, manage all those Bitcoins they're hoarding.

The Early Bird Gets the… Liquidity?

Then there's this other article floating around, some deep dive into why Bitcoin's price action has been so "muted" lately. The tl;dr? Early investors are cashing out.

Apparently, all those "OG" Bitcoin holders—the guys who bought in when BTC was trading for pennies—are finally taking their profits. And who can blame them? If you were sitting on millions of dollars worth of Bitcoin you bought for practically nothing, wouldn't you be looking for an exit strategy?

This Jordi Visser dude calls it "Bitcoin’s Silent IPO." He argues that the ETFs and institutional adoption have created "IPO-like conditions" for early believers. Meaning, they can finally sell their coins without completely tanking the market. Bitcoin Price (BTC) Analysis: Patience Required as Early Investors Sell

"For years, the liquidity simply didn’t exist," he writes. "Try selling $100 million of bitcoin in 2015. You’d crater the price."

But now? Now, they can "methodically distribute their positions" and drive everyone crazy with a "sideways grind." Sounds about right.

The problem? It's a house of cards. Strategy is betting big on Bitcoin, but if the early investors keep cashing out, and the market continues to sour on crypto, what happens then? Do they become the biggest bag holder in history?

The Inevitable Reckoning

Look, I'm not saying Bitcoin is going to zero. Maybe it'll moon again. Maybe it'll become the global reserve currency. Who knows? But I am saying that Strategy's strategy—of just blindly buying Bitcoin and hoping for the best—is incredibly risky. It's like betting your entire company on a single roll of the dice. Sure, you might win big. But you're just as likely to lose everything.

And let's not forget that "other companies have followed Strategy's approach." Which means, if Strategy goes down, it could take a whole lot of other companies with it. Great.

The Myriad prediction market says 96% of respondents don't think Strategy will sell more Bitcoin this year. Okay, but what if they have to? What if the market crashes and they need to raise cash? Are they just going to sit there and watch their entire empire crumble?

I don't know. Maybe I'm being too cynical. Maybe Strategy is playing 4D chess while the rest of us are stuck playing checkers. But honestly...