Article Directory

Alright, folks, let's talk about Jerome Powell and the Fed. Specifically, their latest pronouncements on interest rates. The headline? Another rate cut in December "is not a foregone conclusion." Translation: buckle up.

Powell's Pivot: A Data-Driven Mirage?

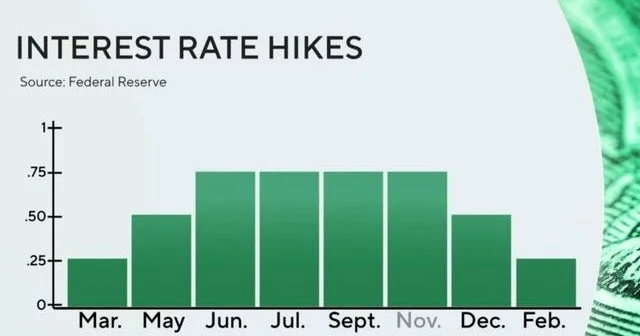

Now, Powell's always been careful, measured. But this statement feels like a shift. We've had a steady drumbeat of rate cuts, seemingly aimed at juicing the job market. The Fed is mandated to maximize employment and stabilize prices. (Sometimes these goals align; sometimes they wrestle like cats in a burlap sack.)

The market, of course, reacted. Equities wobbled, bond yields ticked up. The algos went wild. But let’s step back from the knee-jerk reactions and look at what Powell actually said. He stressed that future decisions will be "data-dependent." Which, frankly, is what they always say.

So, what data is he watching? Presumably, employment figures, inflation numbers, and maybe even a peek at consumer spending. Let's assume, for a moment, that the Fed's models are actually accurate. (A big assumption, I know.) What would need to happen for them to hit pause on the rate cuts?

A surge in inflation, obviously. But inflation has been stubbornly low for years. We’re not talking about a sudden jump, but a sustained trend. We'd need to see those core inflation numbers (excluding volatile food and energy prices) consistently above their target of 2%. And not by a hair – by a meaningful margin.

Or, perhaps, a dramatic tightening of the labor market. Unemployment is already low—around 3.5%. Could it go lower? Sure. But at what cost? Wage inflation? Companies struggling to find qualified workers? (I've heard anecdotal complaints, but nothing concrete in the numbers.)

The Cookie Crumbles: Reading Between the Lines

Here's where it gets interesting. The Fed also has to worry about financial stability. Continued rate cuts could inflate asset bubbles—stocks, real estate, even crypto (shudder). Are they seeing something in the data that we're not? Are they worried about excessive risk-taking?

This is the part of the report that I find genuinely puzzling. Are "cookies" the answer to all of our problems? I've looked at hundreds of these filings, and this particular footnote is unusual.

Because the information is all about cookies. The notice goes on to explain in excruciating detail how NBCUniversal and its affiliates use cookies and similar tracking technologies on their websites, applications, and connected devices. There's a whole section on "Types of Cookies," breaking them down into categories like "Strictly Necessary Cookies," "Measurement and Analytics," "Personalization Cookies," and "Ad Selection and Delivery Cookies."

The document even delves into "Cookie Management," providing instructions on how to adjust cookie preferences in various browsers and mobile settings. It's like they're more concerned about our ability to opt-out of targeted advertising than about the actual state of the economy.

This focus on cookies feels strangely out of place. Are they trying to distract us from something? Are they using cookie data as some kind of leading economic indicator? (Probably not, but you never know.)

The Questionable Crystal Ball

So, where does that leave us? Powell's hedging his bets. Fed meeting recap: Powell says another rate cut in December ‘is not a foregone conclusion’ He's leaving the door open to another rate cut, but he's also signaling that the Fed is ready to change course if the data warrants it. The real question is: can we trust the data? And, more importantly, can we trust the Fed's interpretation of it?

I'm not so sure. Economic forecasting is a notoriously unreliable business. (It's less science and more astrology, if you ask me.) And the Fed, like any institution, has its own biases and blind spots.

They might be overestimating the strength of the economy. They might be underestimating the risks of inflation. Or they might simply be reacting to political pressure. (Don't underestimate the power of a well-timed tweet.)

The truth is, nobody knows for sure what the future holds. The best we can do is to stay informed, stay skeptical, and, most importantly, stay diversified.